February 7

Usage Based Pricing Calculator

Why Cheddar is the Smarter Choice for Usage-Based Billing Over Stripe

Understanding the True Cost of Usage-Based Billing

When it comes to billing, many SaaS companies and businesses with variable pricing models start with Stripe because it’s a well-known brand that is startup friendly and integrates with many products on the market.

However, when dealing with usage-based billing, Stripe is an add-on to an existing platform rather than a purpose-built solution. Cheddar, on the other hand, was designed from the ground up to track usage and generate dynamic invoices, making it a more intuitive usage-based billing platform. Additionally, Cheddar was built for products to scale (and save money at scale).

To illustrate this, we built a Cheddar vs. Stripe Pricing Calculator that determines at what Monthly Recurring Revenue (MRR) Cheddar becomes more cost-effective than Stripe.

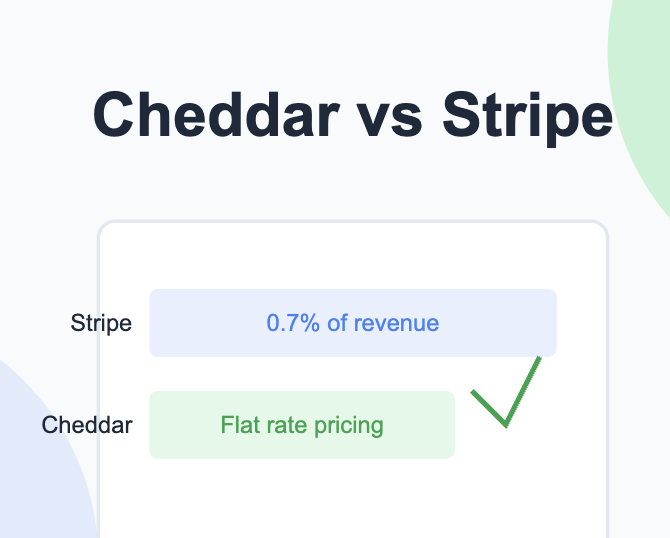

Cheddar vs. Stripe: A Cost Comparison

Our calculator allows users to input their monthly revenue and number of transactions to compare costs.

Let’s break down the findings:

- Stripe’s usage-based billing charges a percentage of revenue, making costs scale directly with your business.

- Cheddar’s pricing now features startup-friendly pricing, reducing the base cost and improving savings for early-stage companies.

- Cheddar becomes significantly cheaper when average transaction values exceed $50 and when total revenue surpasses $20,000.

At this breaking point, companies that scale beyond this threshold find Cheddar dramatically more cost-effective than Stripe. The key difference is that Cheddar’s flat fee + per-transaction model ensures savings as you grow, whereas Stripe’s percentage-based pricing penalizes success.

Why Cheddar Wins for Usage-Based Billing

1. Purpose-Built for Usage Tracking

Unlike Stripe, which retrofitted usage-based billing into its existing payment infrastructure, Cheddar was built specifically for tracking activity and generating dynamic invoices. This means:

- Seamless tracking of events and activities that drive customer charges.

- Automated invoicing without additional engineering overhead.

- No need to build your own metering logic—Cheddar handles it for you.

2. More Payment Gateway Flexibility

Stripe is a payment processor and billing solution, whereas Cheddar is a dedicated billing platform that works with multiple payment processors and gateways, including Stripe. This means businesses can still use Stripe for payment processing but benefit from Cheddar’s superior billing capabilities, especially for usage-based billing. This gives businesses:

- More control over fees and providers.

- The ability to optimize for different geographies and customer types.

- Freedom to switch processors without changing billing infrastructure.

3. Lower, More Predictable Costs at Scale

As your business grows, Stripe’s percentage-based model becomes increasingly expensive. With Cheddar’s startup-friendly pricing:

- The $99/month fee can be waived for early-stage businesses.

- A new pricing structure makes it easier to transition away from Stripe without upfront costs.

- Companies can grow into Cheddar’s model without feeling trapped by early Stripe subsidies.

4. Better Customer Experience with Dynamic Billing

Cheddar’s ability to track usage in real-time and bill dynamically means customers get accurate invoices without manual adjustments. Businesses can:

- Charge customers based on actual usage rather than estimates.

- Offer flexible billing models, including tiered and volume-based pricing.

- Improve customer retention by eliminating surprises on invoices.

Understanding Stripe’s Pricing Model

Many businesses start with Stripe Billing because it appears simple and familiar. However, as revenue and ARPU (Average Revenue Per User) increase, the cumulative fees can become a larger portion of a company’s costs. Cheddar’s flat fee plus transaction-based model provides an alternative that may be more cost-effective as businesses scale. Additionally:

- Stripe’s pricing structure is designed for ease of entry, but businesses growing beyond certain thresholds may benefit from evaluating alternative billing solutions.

- Migrating billing systems can be challenging, which is why it’s essential to choose the right platform from the start.

- Cheddar provides a flexible transition strategy, allowing businesses to continue using Stripe for payment processing while leveraging Cheddar’s billing system.

When Does Cheddar Make More Sense Than Stripe?

While Stripe is a solid choice for early-stage startups and simple subscription models, businesses should consider Cheddar when they:

- Have complex, usage-based pricing models.

- Expect to scale beyond $20K MRR and want to optimize costs.

- Want control over their payment processor options.

- Need real-time usage tracking that ties directly to billing.

Conclusion: The Smarter Choice for Scaling Businesses

Stripe may be the default choice for many companies starting out, but as businesses scale and adopt more dynamic pricing models, Cheddar offers clear advantages in cost, flexibility, and billing intelligence. Our updated calculator proves that at the right revenue levels, Cheddar is the more cost-effective choice, saving companies money while providing a more intuitive billing experience.

If your business relies on usage-based billing, consider a platform built for that exact purpose. Try the Cheddar vs. Stripe Pricing Calculator and see how much you could save!